Rumored Buzz on Summit Business Advisors Llc

Table of ContentsSummit Business Advisors Llc Can Be Fun For EveryoneThe Of Summit Business Advisors LlcThe Buzz on Summit Business Advisors Llc4 Simple Techniques For Summit Business Advisors Llc

Our writers and editors utilized an in-house all-natural language generation system to assist with sections of this article, enabling them to focus on including information that is distinctly useful. The write-up was evaluated, fact-checked and modified by our editorial personnel prior to magazine. When it comes to handling your money, you don't want any person messing it up and that includes you.Some individuals could want to purchase a home soon while others are concentrating on saving for retired life. A great monetary advisor takes into account your family, age, profession and top priorities when crafting your financial goals, and then assists you figure out just how to reach them. Bear in mind that objectives alter.

Whether you have one primary objective or numerous, a monetary advisor is your overview in creating and attaining those goals. The type to use depends on your demands and goals.

CFPs have actually exercised for countless hours and passed an examination to reach this degree, and they're entrusted with a fiduciary duty to run in your ideal passion. If you're simply starting to spend, a robo-advisor is a fantastic introductory factor. When you choose your robo-advisor. Summit Business Advisors, you'll complete a survey that identifies your risk tolerance and assesses your objectives, and your robo-advisor selects your investment profile.

Some Known Incorrect Statements About Summit Business Advisors Llc

It's genuinely the set-it-and-forget-it version. If you're a high-net-worth person, you might need a person to offer you personalized, tailored suggestions and make economic choices on your part. They have strong understanding in handling investments, estates and tax planning and other monetary subjects.

Let's say you wish to retire in 20 years or send your kid to an exclusive college in 10 years. To accomplish your goals, you might need a proficient specialist with the best licenses to help make these plans a fact; this is where an economic expert can be found in. With each other, you and your expert will cover many subjects, consisting of the quantity of cash you need to save, the kinds of accounts you need, the sort of insurance policy you must have (including long-term treatment, term life, impairment, etc), and estate and tax obligation preparation.

On the questionnaire, you will certainly likewise show future pensions and revenue sources, job retired life (http://www.askmap.net/location/7118531/usa/summit-business-advisors-llc) needs, and explain any kind of long-term monetary responsibilities. Basically, you'll detail all present and predicted investments, pensions, gifts, and income sources. Deltek Ajera. The investing element of the survey discuss more subjective subjects, such as your threat resistance and threat capacity

9 Simple Techniques For Summit Business Advisors Llc

It will consider affordable withdrawal prices in retired life from your portfolio properties. In addition, if you are wed or in a long-lasting partnership, the plan will think about survivorship issues and economic circumstances for the making it through partner. After you review the strategy with the consultant and change it as required, you're ready for action.

It is necessary for you, as the customer, to comprehend what your coordinator recommends and why. You need to not comply with an advisor's referrals unquestioningly; it's your money, and you need to recognize exactly how it's being deployed. Keep a close eye on the fees you are payingboth to your advisor and for any kind of funds acquired for you.

Some Ideas on Summit Business Advisors Llc You Should Know

The ordinary base income of a monetary consultant, according to Without a doubt as of June 2024. Note this does not include an approximated $17,800 of annual commission. Any person can collaborate with an economic advisor at any kind of age and at any phase of life. You don't need to have a high internet worth; you simply need to locate a consultant fit to your scenario.

If you can not manage such aid, the Financial Preparation Organization might be able to aid with pro bono volunteer assistance. Financial advisors benefit the client, not the company that employs them. They must be receptive, happy to discuss financial concepts, and keep the client's ideal passion at heart. Otherwise, you should look for a new advisor.

An advisor can suggest feasible renovations to your strategy that may help you attain your objectives extra properly. Finally, if you do not have the moment or rate of interest to manage your finances, that's an additional excellent reason to hire a monetary advisor. Deltek Ajera Support. Those are some basic reasons you could informative post need an advisor's professional aid

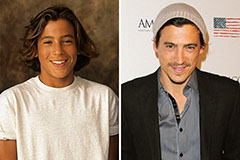

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now! Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!